Historically, whistleblowers have played an important role in calling out corporate misconduct and potential harm to consumers and the community. There is even an annual International Whistleblower Day to recognise the positive contribution of whistleblowers in society, to be held this year on July 30th.

Generally, a whistleblower is someone who reports (when they have reasonable grounds to suspect it is occurring) misconduct or an improper state of affairs involving an entity.

Whistleblowing is considered by the Australian Government to be a critical tool in ensuring a transparent, accountable, and safe corporate culture. Many of the protections for whistleblowers under Australian law have been designed to ensure that whistleblowers feel supported and secure to raise issues.

Whistleblower protections have been expanded over recent years to provide whistleblowers with greater protection in Australia, and these changes may affect your business.

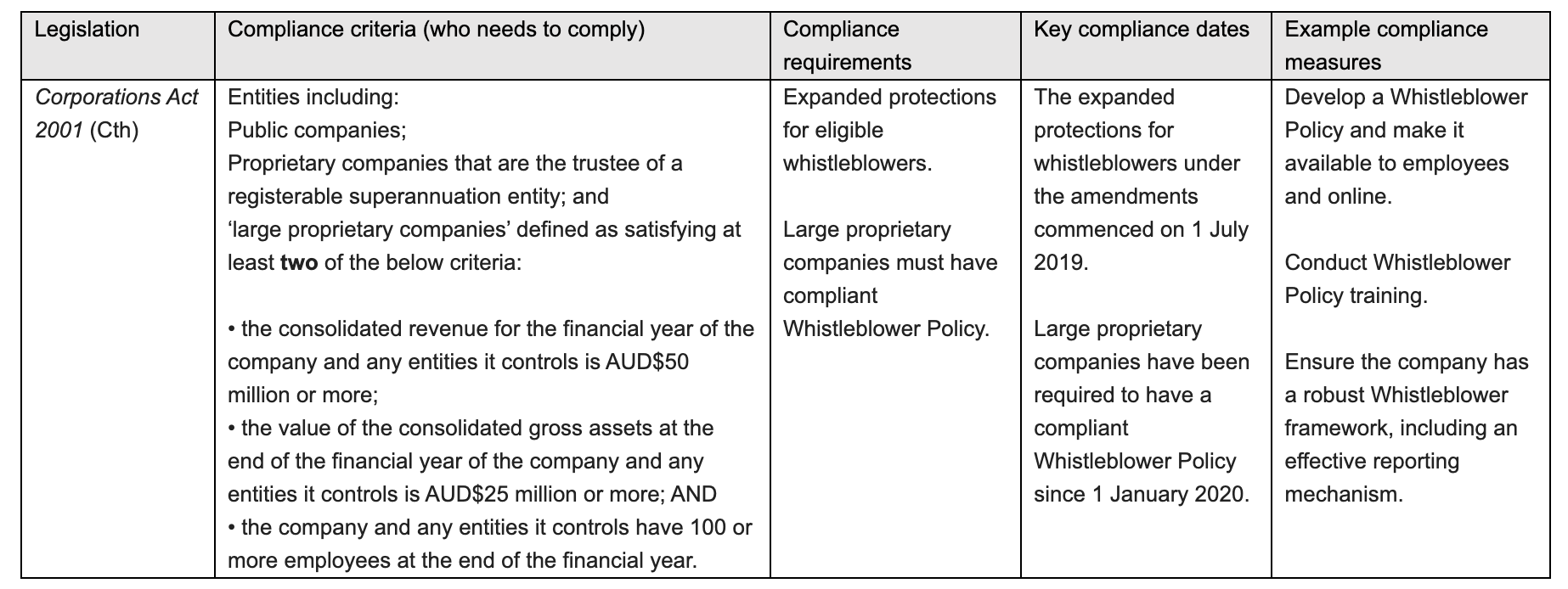

Many Australian companies are required to have a compliant whistleblower policy in place under the expanded protections for corporate whistleblowers in the whistleblower protection regime under the Corporations Act 2001 (Cth) (Corporations Act), and to make that policy available to every officer and employee of the company. Those entities that are subject to the mandatory requirements include:

- public companies;

- large proprietary companies (see table below);

- proprietary companies that are the trustee of a registerable superannuation entity.

Failure to comply with the requirement to have, and make available, a whistleblower policy is a strict liability offence.

The specific content and implementation requirements for a compliant whistleblower policy are quite detailed and prescriptive, and many pre-existing whistleblower policies are unlikely to comply with the new laws.

The table below sets out the key compliance criteria and thresholds to assist you with determining whether these whistleblower compliance requirements are relevant to your business. However, even for businesses yet to meet the compliance thresholds, having a compliant whistleblower policy may assist you to ensure you do not breach whistleblower protections and help build a strong compliance and governance culture in your organisation.

Not only that, a robust whistleblower framework is a powerful tool to assist in ensuring you are meeting critical ESG requirements and to provide assurance of your ESG reporting measures.

Recently, Australia’s corporate watchdog conducted a targeted review of the whistleblower policies and procedures being implemented in Australia. On 2 March 2023, the Australian Securities and Investments Commission (ASIC) published its report, ‘Good practices for handling whistleblower disclosures’- Report 758, to help entities improve their arrangements for handling whistleblower disclosures. The report was based on a review ASIC undertook of 7 entities’ whistleblower programs from a cross-section of industries (Australia and New Zealand Banking Group Ltd, AustralianSuper Pty Ltd, BHP Group Ltd, Commonwealth Bank of Australia, Netwealth Group Ltd, Treasury Wine Estates Ltd and Woolworths Group Ltd).

The report is available here: https://download.asic.gov.au/media/wsjegua5/rep758-published-2-march-2023.pdf .

To summarise some of the high-level findings: ASIC found that programs with thoughtful and well-publicised arrangements for protecting whistleblowers and handling disclosures received useful reports and tip offs about concerns and issues in the workplace. In particular, the report identified that businesses with strong whistleblower programs took the following steps:

- “established a strong foundation for the program—for example, through procedures and systems to embed the program’s requirements;

- fostered a culture and practices to support whistleblowers;

- informed and trained those involved in receiving or handling disclosures about protecting whistleblowers and treating material confidentially;

- monitored, reviewed, and improved the program, including seeking feedback from whistleblowers;

- used information from disclosures to address underlying harms and improve company performance;

- embedded senior executive accountability for the program;

- created frameworks to entrench effective director oversight.”

At PB, we have experience in both drafting ASIC-compliant whistleblower policies, and providing training sessions for staff to assist with implementing a whistleblower framework. Contact us for advice on developing your whistleblower program today.

Products & Services

1300 774 788

service@peripheralblue.com.au

Suite 17, 116-120 Melbourne St, Nth Adelaide, SA 5006

© 2023 Peripheral Blue | All Rights Reserved | ABN 61855198272 Privacy Policy | Terms & Conditions

Products & Services

1300 774 788

service@peripheralblue.com.au

Suite 17, 116-120 Melbourne St, Nth Adelaide, SA 5006

© 2023 Peripheral Blue | All Rights Reserved

ABN 61855198272